It's shaping up to be another interesting year for investment markets in 2012.

In my previous commentary from a few weeks ago, I discussed how investment markets were polarized between two widely divergent forces - the challenging reality of the slowing U.S. economy and Europe's deteriorating sovereign debt crisis versus the hope that U.S. and European policy makers would intervene with extraordinary measures to combat these issues. But after what has now been several months of choppy action for investment markets, it appears that the forces of reality may soon overwhelm any lingering hope.

The key concern as we close out 2011 and enter into the New Year is the European sovereign debt crisis. While the U.S. economy has actually shown some signs of improvement in recent weeks, conditions in Europe are continuing to unravel. Whereas Europe's sovereign debt problems were once confined to smaller periphery nations such as Greece, Ireland and Portugal (a combined 6% of Euro Zone GDP), it has since spread in earnest to the vastly larger core nations of France, Italy and Spain (a combined 56% of Euro Zone GDP). As a result, the probability for a major sovereign default in Europe is rising with each passing day, and the fallout effects for the global economy could become severe.

European policy makers squandered what could end up being their last chance to finally get ahead of the problem. The European Central Bank met on Thursday with expectations that they may surprise with a larger than expected interest rate cut. Instead, they delivered only what the market was expecting and couldn't even come to a consensus on that decision, as some committee members were arguing for even less. European leaders also held a summit on Thursday and Friday with hopes that decisive action would finally be taken to address the mounting debt problems across the region. Instead, EU leaders continued to dither and struggled to come to consensus on even minor points. The summit ended with an agreement characterized by the same vagueness and indecision that has limited their ability to adequately address the problem all along. Although EU leaders are scheduled to meet again in March 2012, by then it may be too late.

A critical market to watch in the coming weeks is Italy, which is the third largest bond market in the world. In 2012, Italy has sovereign debt redemptions needing to be refinanced totaling nearly $300 billion. This includes $43 billion at the end of January and another $63 billion at the end of February. As long as European policy inaction persists, the odds are rising that Italy may forced to default when attempting to carrying out one of these massive refinancing rounds. The potential is also rising for a hard default by another sovereign or a systemically important banking institution as well. And such an event would be the likely catalyst of another contagion like we saw starting in late 2008.

For these reasons, it is prudent to begin dialing down risk in investment portfolios at the present time. Although the situation in Europe has deteriorated meaningfully in recent months, the U.S. stock market as measured by the S&P 500 is actually well above early October lows thanks in part to several additional injections of stimulus by the U.S. Federal Reserve. And given that short-term risks to the downside meaningfully outweigh the potential to the upside, I have been using recent strength as an opportunity to lock in recent gains on stock positions and reallocate. Sales have focused on stocks that have a larger percentage of sales coming from international markets including Europe. The few remaining stock positions are those that have U.S. focused businesses from defensive sectors such as Consumer Staples and Utilities.

The variety of other asset classes beyond the stock market are positioned to hold up well if not benefit in the event of a full blown crisis event unfolding in Europe. Two categories that would likely move to the upside during such an episode are U.S. Treasury Inflation Protected Securities (TIPS) and Agency Mortgage Backed Securities (MBS). Fortunately, both would also be expected to perform consistently well if the European situation gets resolved. As a result, portfolio weights have been increased to both of these asset classes. TIPS have particular appeal because they represent a safe haven during times of crisis and have performed with consistent upside during both periods of economic calm and instability. Agency MBS is also poised to benefit due to its short duration - many of these bonds mature within one to three years - the virtually explicit backing of the U.S. government and its generous yield premium relative to comparable U.S. Treasuries. In addition, if the U.S. Federal Reserve were to add more stimulus with the launch of a third round of quantitative easing, Agency MBS is almost certainly what they will be buying in the dual effort of trying to support U.S. banks and the housing market. Given the already limited supply of Agency MBS, history has shown that it has been worthwhile to own the MBS securities that the Fed is seeking to buy.

Another category that should hold steady and is likely to benefit regardless of whether we see crisis or resolution is Utilities Preferred Stocks. Most of the preferred stock market is concentrated in financials, which is problematic because the banks have already come under pressure in anticipation of a crisis episode. But a select group of non-financial preferred stocks exist in the Utilities sector that are stable and generate predictable cash flows, as most people will continue to keep their lights on regardless of the economic environment and these preferred stocks directly benefit from this characteristic. While these securities might experience an initial price shock during a crisis episode due to mechanical market forces, they are likely to quickly recover their value within days and provide another safe haven destination for investors.

The next asset class worth mentioning are the precious metals of Gold and Silver. Gold is the classic hard asset defense against both crisis as well as aggressive stimulus efforts from the U.S. Federal Reserve that weakens the U.S. dollar. During a crisis episode, however, it may be subject to short-term price shocks. This is due to the fact that it is a highly liquid investment that is often sold to raise cash during mass liquidation phases. But any such sell-offs have historically proven to be short lived and ideal buying opportunities, as the price quickly recovers as investors seek to snap up this safe haven asset on sale. Thus, Gold positions remain in portfolios but remain under close watch. Silver is the far more volatile of the two precious metals, but it serves two functions. First, it provides direct protection against an aggressive monetary policy move by the U.S. Federal Reserve or other global central banks. It also provides a vehicle to maintain stock like exposure with a much smaller concentration of overall portfolio assets. While the percentage allocation to Silver in portfolios is relatively small, it serves as an important portfolio hedge against a swift and decisive policy turn to stimulate by global central banks.

Lastly, it is worthwhile to make mention of cash. While I typically prefer to be fully invested during most markets, an allocation to cash makes sense in the current environment. It enables for the short-term protection of principal value while also enabling the flexibility to step in and potentially purchase stocks and other assets at a discount following any liquidation sell-offs.

Perhaps in the end, European policy makers will finally take the decisive action needed to address their crisis (this, of course, assumes that they still have time to do so). Stocks would likely cheer the news and it would go a long way in helping to return a sense of calm to the markets. Unfortunately, such an outcome is becoming an unsettlingly low probability event as each day passes. Even if the U.S. Federal Reserve were to launch QE3 in the weeks ahead, the positive impact on stocks would likely be muted if Europe remains unresolved. As a result, the priority for portfolios as we move toward the end of the year is to continue dialing down risk. This way, if a crisis event were to erupt, portfolios will already be positioned in advance to hold steady if not benefit from such a scenario. And if it turns out that crisis is averted, the opportunity will still be available to reallocate back into higher risk assets such as stocks at that time. I will continue to keep a close eye on the markets and will keep you updated as events unfold.

This post is for information purposes only. There are risks involved with investing including loss of principal. Gerring Wealth Management (GWM) makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections made by GWM. There is no guarantee that the goals of the strategies discussed by GWM will be met.

Monday, December 12, 2011

Sunday, November 6, 2011

Opposing Forces

Two widely divergent forces are currently impacting investment markets.

On the downside is the challenging reality. The pace of the U.S. economic recovery remains sluggish and the threat of a recession in the coming months is rising. Looking abroad, policy makers have struggled for well over a year to contain the European crisis, but the situation continues to deteriorate. Greece is teetering on the brink of default and problems are worsening in major sovereigns such as Italy, Spain and even France. The end result in Europe may ultimately lead to another global financial contagion. The threat of such an outcome is deeply negative for risk assets such as stocks, but would benefit safe haven assets such as U.S. Treasuries and Gold.

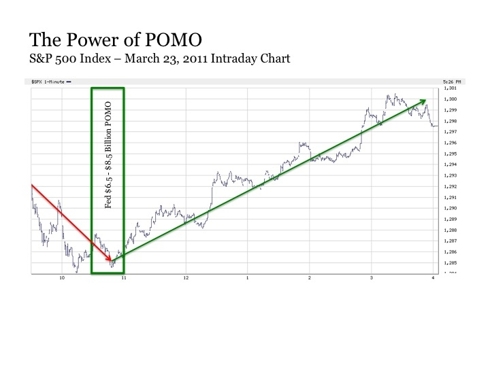

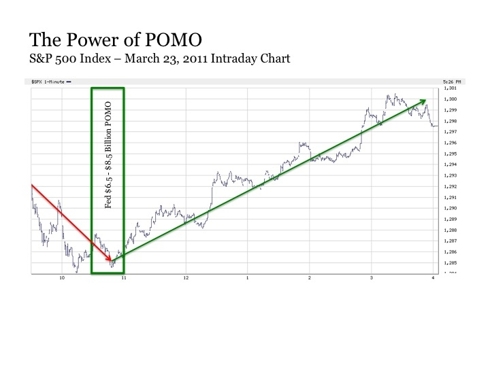

On the upside is the hope by investors that the U.S. Federal Reserve (the Fed) will intervene with more aggressive monetary support. The most recent Fed stimulus program known as QE2 ended on June 30. And stocks began plunging sharply within weeks after the end of QE2, declining by nearly -20% from July 22 to August 8. But then the Fed stepped in with a new round of stimulus by promising to keep interest rates at 0% until mid-2013. This helped put a floor under the market. After stocks went on to thrash back and forth through August and September, the Fed launched another stimulus program known as Operation Twist at the beginning of October, and stocks have rallied by +14% in the weeks since. Finally, the Fed just this past Wednesday strongly suggested that yet another round of stimulus in QE3 would soon be on its way. Stocks tend to react euphorically to Fed stimulus, so this aggressive outpouring of monetary support has certainly helped to offset the extreme risks currently facing the market to this point.

These two strongly opposing forces have resulted in a wildly volatile market environment on a day-to-day basis. On days when investors are optimistic about the U.S. outlook or believe the situation in Europe may be headed toward a resolution, the stock market soars. But on days when it appears that the situation may be set to unravel Europe or the economy is weakening in the U.S., stocks plunge sharply. Such dramatic up and down shifts have been occurring daily if not hourly during any given trading session.

Given these diametrically opposing forces, two very different outcomes both appear high probable in the coming months. The first would be the outbreak of a full blown crisis in Europe and a recession in the U.S., which would likely push stocks sharply lower. The second would be a stabilization of the situation in Europe, which would instead allow the forces of Fed stimulus to propel stocks sharply higher.

The meaningful probability associated with these two widely divergent outcomes emphasizes the importance of maintaining portfolio hedging strategies to navigate the current environment. Recent portfolio adjustments in response to this backdrop include shifting away from exposures that would be too heavily impacted by one single outcome. Relating it to a seesaw, it is the equivalent of moving away from either end of the lever and toward the fulcrum. This includes exiting positions in nominal U.S. Treasuries and more economically sensitive stocks toward positions such as Treasury Inflation Protected Securities (TIPS), Gold and selected defensive stocks that stand to benefit from either outcome. The emphasis of such a risk controlled strategy is to neutralize the potential downside while also capturing the upside opportunity associated with either outcome.

On the downside is the challenging reality. The pace of the U.S. economic recovery remains sluggish and the threat of a recession in the coming months is rising. Looking abroad, policy makers have struggled for well over a year to contain the European crisis, but the situation continues to deteriorate. Greece is teetering on the brink of default and problems are worsening in major sovereigns such as Italy, Spain and even France. The end result in Europe may ultimately lead to another global financial contagion. The threat of such an outcome is deeply negative for risk assets such as stocks, but would benefit safe haven assets such as U.S. Treasuries and Gold.

On the upside is the hope by investors that the U.S. Federal Reserve (the Fed) will intervene with more aggressive monetary support. The most recent Fed stimulus program known as QE2 ended on June 30. And stocks began plunging sharply within weeks after the end of QE2, declining by nearly -20% from July 22 to August 8. But then the Fed stepped in with a new round of stimulus by promising to keep interest rates at 0% until mid-2013. This helped put a floor under the market. After stocks went on to thrash back and forth through August and September, the Fed launched another stimulus program known as Operation Twist at the beginning of October, and stocks have rallied by +14% in the weeks since. Finally, the Fed just this past Wednesday strongly suggested that yet another round of stimulus in QE3 would soon be on its way. Stocks tend to react euphorically to Fed stimulus, so this aggressive outpouring of monetary support has certainly helped to offset the extreme risks currently facing the market to this point.

These two strongly opposing forces have resulted in a wildly volatile market environment on a day-to-day basis. On days when investors are optimistic about the U.S. outlook or believe the situation in Europe may be headed toward a resolution, the stock market soars. But on days when it appears that the situation may be set to unravel Europe or the economy is weakening in the U.S., stocks plunge sharply. Such dramatic up and down shifts have been occurring daily if not hourly during any given trading session.

Given these diametrically opposing forces, two very different outcomes both appear high probable in the coming months. The first would be the outbreak of a full blown crisis in Europe and a recession in the U.S., which would likely push stocks sharply lower. The second would be a stabilization of the situation in Europe, which would instead allow the forces of Fed stimulus to propel stocks sharply higher.

The meaningful probability associated with these two widely divergent outcomes emphasizes the importance of maintaining portfolio hedging strategies to navigate the current environment. Recent portfolio adjustments in response to this backdrop include shifting away from exposures that would be too heavily impacted by one single outcome. Relating it to a seesaw, it is the equivalent of moving away from either end of the lever and toward the fulcrum. This includes exiting positions in nominal U.S. Treasuries and more economically sensitive stocks toward positions such as Treasury Inflation Protected Securities (TIPS), Gold and selected defensive stocks that stand to benefit from either outcome. The emphasis of such a risk controlled strategy is to neutralize the potential downside while also capturing the upside opportunity associated with either outcome.

Monday, August 8, 2011

The Day After The Downgrade

It was quite a day in the stock market, which plunged by -6.7% as measured by the S&P 500 Index. Given the events of the day, I wanted to provide a brief update on the markets and portfolio performance.

I'll begin with the bottom line. portfolios ended up for the day. Although gains for the day were modest at less than +1%, this result was favorable given the considerable downside pressure coming from stocks. Portfolio gains were supported primarily by precious metals such as Gold (+3.3% today), Silver (+1.7%) and Agnico Eagle Mines (+1.4%). U.S. Treasuries also posted another strong advance, with government debt reaching new highs across the yield curve including TIPS (+1.2%), 3-7 Year Treasuries (+0.6%), 7-10 Year Treasuries (+1.6%) and 20+ Year Treasuries (+3.2%). As a result, the hedging strategies in place to protect portfolios against major downside stock market events had a positive net effect today.

One fact coming out of today was notable. Given that S&P, which is one of the three major credit rating agencies, downgraded the United States from AAA to AA+, it might have been reasonable to expect that U.S. Treasuries would have declined substantially today. Instead, they traded sharply higher.

This highlights an important point. The sell off in stocks today had little to do with the U.S. credit downgrade. Instead, it had much more to do with the ongoing financial crisis in Europe. Over the weekend and into today, European leaders worked to try and resolve what is a rapidly deteriorating situation in Spain and Italy. Despite their latest efforts to address the problem, financial markets remain unsatisfied and are starting to become impatient. Hence the sell off in stocks today and the move to Gold, Silver and U.S. Treasuries, which are all still considered safe havens during times of market uncertainty. Highlighting the fact that Europe remains the key overhang for the market, European financial preferred stocks were down between -10% to -20% today alone. These types of moves in preferred stocks are highly unusual and help isolate the source of market stress.

As for the U.S. credit rating downgrade, it will likely continue to do its part to add to market uncertainty and volatility, but its impact is currently secondary. However, any unanticipated fallout effects from the downgrade will likely only begin to become apparent after a few weeks or longer if at all. I will be watching this very closely and will keep you updated if I begin to see such effects beginning to boil to the surface.

Looking ahead, the stock market is now well overdue for a meaningful bounce higher, as it hasn't been this oversold since late 2008. But the fact that it is oversold does not mean that it won't decline further. After all, it was also oversold when the S&P was at both 1250 and 1200 just a few days ago, and today it closed at 1119. And any bounce higher in stocks will likely be short lived - perhaps a few days to a week or two at most - given the weakening global economic outlook and the ongoing financial challenges in Europe.

The one caveat to this stock outlook is the potential for action by global central banks including the U.S. Federal Reserve (Fed) or the European Central Bank (ECB). For example, if the Fed were to announce another round of stimulus (QE3) either at their FOMC meeting tomorrow or at Jackson Hole at the end of the month, this could be the catalyst for a new rally higher in stocks. Another example would be unprecedented steps by the ECB to finally try to get ahead of the crisis in Europe. Once again, I will keep you updated on any developments on this front.

In the meantime, the emphasis will remain on keeping hedging strategies in place including positions in precious metals and U.S. Treasuries in working to generate further portfolio upside amid stock market turbulence. Taking the opportunity when it presents itself to selectively add high quality stock names that have been pulled lower along with the broader stock market sell off will also be a priority in the coming days.

I'll begin with the bottom line. portfolios ended up for the day. Although gains for the day were modest at less than +1%, this result was favorable given the considerable downside pressure coming from stocks. Portfolio gains were supported primarily by precious metals such as Gold (+3.3% today), Silver (+1.7%) and Agnico Eagle Mines (+1.4%). U.S. Treasuries also posted another strong advance, with government debt reaching new highs across the yield curve including TIPS (+1.2%), 3-7 Year Treasuries (+0.6%), 7-10 Year Treasuries (+1.6%) and 20+ Year Treasuries (+3.2%). As a result, the hedging strategies in place to protect portfolios against major downside stock market events had a positive net effect today.

One fact coming out of today was notable. Given that S&P, which is one of the three major credit rating agencies, downgraded the United States from AAA to AA+, it might have been reasonable to expect that U.S. Treasuries would have declined substantially today. Instead, they traded sharply higher.

This highlights an important point. The sell off in stocks today had little to do with the U.S. credit downgrade. Instead, it had much more to do with the ongoing financial crisis in Europe. Over the weekend and into today, European leaders worked to try and resolve what is a rapidly deteriorating situation in Spain and Italy. Despite their latest efforts to address the problem, financial markets remain unsatisfied and are starting to become impatient. Hence the sell off in stocks today and the move to Gold, Silver and U.S. Treasuries, which are all still considered safe havens during times of market uncertainty. Highlighting the fact that Europe remains the key overhang for the market, European financial preferred stocks were down between -10% to -20% today alone. These types of moves in preferred stocks are highly unusual and help isolate the source of market stress.

As for the U.S. credit rating downgrade, it will likely continue to do its part to add to market uncertainty and volatility, but its impact is currently secondary. However, any unanticipated fallout effects from the downgrade will likely only begin to become apparent after a few weeks or longer if at all. I will be watching this very closely and will keep you updated if I begin to see such effects beginning to boil to the surface.

Looking ahead, the stock market is now well overdue for a meaningful bounce higher, as it hasn't been this oversold since late 2008. But the fact that it is oversold does not mean that it won't decline further. After all, it was also oversold when the S&P was at both 1250 and 1200 just a few days ago, and today it closed at 1119. And any bounce higher in stocks will likely be short lived - perhaps a few days to a week or two at most - given the weakening global economic outlook and the ongoing financial challenges in Europe.

The one caveat to this stock outlook is the potential for action by global central banks including the U.S. Federal Reserve (Fed) or the European Central Bank (ECB). For example, if the Fed were to announce another round of stimulus (QE3) either at their FOMC meeting tomorrow or at Jackson Hole at the end of the month, this could be the catalyst for a new rally higher in stocks. Another example would be unprecedented steps by the ECB to finally try to get ahead of the crisis in Europe. Once again, I will keep you updated on any developments on this front.

In the meantime, the emphasis will remain on keeping hedging strategies in place including positions in precious metals and U.S. Treasuries in working to generate further portfolio upside amid stock market turbulence. Taking the opportunity when it presents itself to selectively add high quality stock names that have been pulled lower along with the broader stock market sell off will also be a priority in the coming days.

This post is for information purposes only. There are risks involved with investing including loss of principal. Gerring Wealth Management (GWM) makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections made by GWM. There is no guarantee that the goals of the strategies discussed by GWM will be met.

Thursday, August 4, 2011

Thursday's Stock Decline

Thursday was a tough day for stocks to say the least. Overall, stocks as measured by the S&P 500 declined by -4.71%, which marked the worst one day performance for stocks since before the March 2009 lows.

The primary driver for the sell off was the situation in Europe. In recent days, Spain and Italy, which both rank among the twelve largest economies in the world, have come under increasing pressure due to their government debt problems. The European Central Bank held a meeting today where it was hoped that they would provide some clarity on how they would address the problems in these two ailing countries. Instead, they managed to perplex the market with several policy decisions that were widely inconsistent with recent actions and out of step with the views of Eurogroup leaders and the International Monetary Fund. This sparked market concerns that confusion and lack of coordination among European leaders may result in the current crisis eventually growing out of control. From there, the stock market rout was on.

Fortunately, portfolios were prepared for today's events. While money was draining out of stocks, it was flowing into U.S. Treasuries. As a result, a heavy portfolio weighting to Treasuries added considerable value. For example, longer duration U.S. Treasuries (maturing in over 20 years) gained +3.56% today, and other areas of the Treasury market also rose +1% or more. This helped meaningfully offset the impact of the stock market decline. And although Gold sold off today, its decline was only -0.53%. In total, any declines in portfolio value were limited to considerably less than -1%.

Looking ahead, today's stock drop had the feel of liquidation selling by financial institutions and hedge funds, which was a common occurrence in late 2008 and early 2009 during the days following the outbreak of the financial crisis. Supporting this idea was the fact that several stocks were actually up in the late morning, but ended the day down -5% or more. Such volatile price activity is a sign of sellers being forced to liquidate into a stock market where there's not enough buyers to pick up the slack. And when such liquidation selling gets underway, it's unpredictable to say exactly when it's going to end. But the stock market is now oversold - it has gone down too far, too fast - and many high quality stocks are now considerably less expensive today than they were just a few weeks ago. Thus, this sell off should provide the opportunity to add selected high quality names once the stock market finds some stability. The only question is whether this stability comes at 1200 on the S&P where it closed today or at an even lower level before its all said and done. The next few trading days will tell us a lot in this regard.

The primary driver for the sell off was the situation in Europe. In recent days, Spain and Italy, which both rank among the twelve largest economies in the world, have come under increasing pressure due to their government debt problems. The European Central Bank held a meeting today where it was hoped that they would provide some clarity on how they would address the problems in these two ailing countries. Instead, they managed to perplex the market with several policy decisions that were widely inconsistent with recent actions and out of step with the views of Eurogroup leaders and the International Monetary Fund. This sparked market concerns that confusion and lack of coordination among European leaders may result in the current crisis eventually growing out of control. From there, the stock market rout was on.

Fortunately, portfolios were prepared for today's events. While money was draining out of stocks, it was flowing into U.S. Treasuries. As a result, a heavy portfolio weighting to Treasuries added considerable value. For example, longer duration U.S. Treasuries (maturing in over 20 years) gained +3.56% today, and other areas of the Treasury market also rose +1% or more. This helped meaningfully offset the impact of the stock market decline. And although Gold sold off today, its decline was only -0.53%. In total, any declines in portfolio value were limited to considerably less than -1%.

Looking ahead, today's stock drop had the feel of liquidation selling by financial institutions and hedge funds, which was a common occurrence in late 2008 and early 2009 during the days following the outbreak of the financial crisis. Supporting this idea was the fact that several stocks were actually up in the late morning, but ended the day down -5% or more. Such volatile price activity is a sign of sellers being forced to liquidate into a stock market where there's not enough buyers to pick up the slack. And when such liquidation selling gets underway, it's unpredictable to say exactly when it's going to end. But the stock market is now oversold - it has gone down too far, too fast - and many high quality stocks are now considerably less expensive today than they were just a few weeks ago. Thus, this sell off should provide the opportunity to add selected high quality names once the stock market finds some stability. The only question is whether this stability comes at 1200 on the S&P where it closed today or at an even lower level before its all said and done. The next few trading days will tell us a lot in this regard.

This post is for information purposes only. There are risks involved with investing including loss of principal. Gerring Wealth Management (GWM) makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections made by GWM. There is no guarantee that the goals of the strategies discussed by GWM will be met.

Sunday, July 31, 2011

Beyond the Debt Ceiling Debate

The recent national drama is drawing to a close. After weeks of intense negotiation, it appears that politicians in Washington have come to an agreement to raise the debt ceiling. Investment markets are cheering the news, as stocks are signaling a strong opening when trading resumes tomorrow. The relief rally is only likely to last a few days, however, as far greater challenges lie ahead in the coming weeks. As a result, the priority is to keep portfolios focused on the investments that have been rising while stocks have been struggling.

Although the media was transfixed with the debate, the debt ceiling issue and the risk of the U.S. defaulting on its debt was never much of a concern for investment markets over the last few weeks. If it had been, we would have likely seen a major sell off in Treasuries with yields spiking higher. Instead, the Treasury market has been in rally mode, gaining +3.2% for the month of July including +1.3% last week in the final tense days leading up to the ultimate resolution.

So what explains why stocks have been struggling over the past few weeks? Certainly, the uncertainty resulting from the debt ceiling debate has not helped stocks, but this has been an ancillary reason at best. Instead, three factors have had stocks under increasing pressure, and these challenges will still remain once the debt ceiling debate goes away. They are the following:

1. The Economy is Slowing

A growing economy is the primary fuel to sustain higher stock prices. But nearly all signals suggest that the economy is weakening with each passing month and recession risks are on the rise.

2. Fiscal and Monetary Stimulus is Spent

A primary driver of the market rally over the last two years has been the massive support from government spending and Fed stimulus programs like near zero interest rates, QE1 and QE2. But a key takeaway from the debt ceiling debate is that any additional government spending to boost the economy is highly unlikely going forward. And the Fed’s QE2 program came to an end on June 30 with no talk of QE3 coming any time soon.

3. The European Crisis Keeps Getting Worse

Euro Zone leaders announced a major rescue package on July 21 that was supposed to provide the continent six months to a year to regroup and stabilize. But problems are already starting to resurface after only a week. And although the issue is in Europe, it has the potential for major negative spillover effects on the global banking system including the U.S. Looking ahead, Spain and Italy are the countries that are likely to garner the most media attention for their problems in the coming weeks.

So while we’re likely to see stocks rally strongly over the next few days in celebration of the debt ceiling debate finally ending, they’re likely to soon falter and begin struggling once again primarily for these three reasons.

Fortunately, a variety of asset classes perform very well in such economic environments like we have today, and portfolios have been positioned to benefit. These include bonds such as U.S. Treasuries and precious metals such as Gold, both of which are considered safe haven investments during times of uncertainty. Both of these categories have been performing very well over the past several weeks and portfolios have been meaningfully weighted to both Treasuries and Gold to capitalize. Treasuries are up +6.8% for 2011 year to date including a +3.2% advance in July, while Gold is up +14.1% for the year including an +8.4% gain this past month.

In the coming days, the debt ceiling relief rally should provide a good trading opportunity to lock in gains on selected stock positions. And the accompanying safe haven sell off may also provide the potential to add to existing bond and precious metals positions on the dip, as these are the categories that are likely to continue to perform well in the coming months as markets work to navigate through ongoing economic challenges.

I will continue to keep you posted as events unfold.

Although the media was transfixed with the debate, the debt ceiling issue and the risk of the U.S. defaulting on its debt was never much of a concern for investment markets over the last few weeks. If it had been, we would have likely seen a major sell off in Treasuries with yields spiking higher. Instead, the Treasury market has been in rally mode, gaining +3.2% for the month of July including +1.3% last week in the final tense days leading up to the ultimate resolution.

So what explains why stocks have been struggling over the past few weeks? Certainly, the uncertainty resulting from the debt ceiling debate has not helped stocks, but this has been an ancillary reason at best. Instead, three factors have had stocks under increasing pressure, and these challenges will still remain once the debt ceiling debate goes away. They are the following:

1. The Economy is Slowing

A growing economy is the primary fuel to sustain higher stock prices. But nearly all signals suggest that the economy is weakening with each passing month and recession risks are on the rise.

2. Fiscal and Monetary Stimulus is Spent

A primary driver of the market rally over the last two years has been the massive support from government spending and Fed stimulus programs like near zero interest rates, QE1 and QE2. But a key takeaway from the debt ceiling debate is that any additional government spending to boost the economy is highly unlikely going forward. And the Fed’s QE2 program came to an end on June 30 with no talk of QE3 coming any time soon.

3. The European Crisis Keeps Getting Worse

Euro Zone leaders announced a major rescue package on July 21 that was supposed to provide the continent six months to a year to regroup and stabilize. But problems are already starting to resurface after only a week. And although the issue is in Europe, it has the potential for major negative spillover effects on the global banking system including the U.S. Looking ahead, Spain and Italy are the countries that are likely to garner the most media attention for their problems in the coming weeks.

So while we’re likely to see stocks rally strongly over the next few days in celebration of the debt ceiling debate finally ending, they’re likely to soon falter and begin struggling once again primarily for these three reasons.

Fortunately, a variety of asset classes perform very well in such economic environments like we have today, and portfolios have been positioned to benefit. These include bonds such as U.S. Treasuries and precious metals such as Gold, both of which are considered safe haven investments during times of uncertainty. Both of these categories have been performing very well over the past several weeks and portfolios have been meaningfully weighted to both Treasuries and Gold to capitalize. Treasuries are up +6.8% for 2011 year to date including a +3.2% advance in July, while Gold is up +14.1% for the year including an +8.4% gain this past month.

In the coming days, the debt ceiling relief rally should provide a good trading opportunity to lock in gains on selected stock positions. And the accompanying safe haven sell off may also provide the potential to add to existing bond and precious metals positions on the dip, as these are the categories that are likely to continue to perform well in the coming months as markets work to navigate through ongoing economic challenges.

I will continue to keep you posted as events unfold.

This post is for information purposes only. There are risks involved with investing including loss of principal. Gerring Wealth Management (GWM) makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections made by GWM. There is no guarantee that the goals of the strategies discussed by GWM will be met.

Monday, July 11, 2011

2011 Q3 Preview: A Second Look Behind the Curtain

In the film classic The Wizard of Oz, Dorothy follows the yellow brick road to see the magical Wizard, who supposedly has the powers to grant her wish to return home. But upon her arrival in the Emerald City, the Wizard’s curtain opens to reveal nothing other than an ordinary man carrying out a charade. Investors find themselves taking a similar look behind the market curtain as we move into the third quarter of 2011.

The Fed’s stimulus program – known as QE2 – came to an end on June 30. The idea behind the Fed’s effort was to provide support to the U.S. economy until it had recovered enough to stand on its own. Back in April 2010, investors had their first opportunity to look behind the market curtain when QE1 came to an end. And they did not like what they had found. The economy remained far too weak and the threat of another financial crisis was emanating from Europe. Stocks quickly plunged as a result. But unlike in the Wizard of Oz, the curtain was quickly pulled shut with the introduction of QE2. The message from the Fed – come back a year from now in June 2011 and the magical economy you’ve been waiting for will finally be here.

Upon drawing the curtain back a second time in July 2011, investors are still not bound to like what they’ve found. The economic recovery remains sluggish with job creation over the last few months all but stalled. The urgency of the crisis in Europe has spread from smaller countries like Greece to much larger nations like Italy. And all the while the U.S. government is deadlocked in a debate over raising the debt ceiling, only adding to the uncertainty.

Stocks have been remarkably resilient to this point in the face of mounting risks. But for how much longer? The stock market has a lot of air under it, as strong gains over the last few years have been justified by expectations that the economy would eventually recover strongly enough to support it. Unfortunately, this has not been the case. And the Fed’s QE stimulus that has helped lift stocks higher to this point has now gone away. As a result, it could be a very difficult time for stocks in the coming months. And the same is true for industrial and agricultural commodities for all of the same reasons.

Fortunately, stocks are only one of many asset class categories available in investment markets to capture opportunity and generate strong returns. And a variety of asset classes have attractive prospects as we move on in the Post QE2 marketplace. I’ve provided a brief summary on each below.

Gold – Although the yellow metal has risen strongly for many years, further upside is likely as long as global economic instability persists and major currencies such as the U.S. dollar and the euro suffer from a lack of confidence.

U.S. Treasuries and Treasury Inflation Protected Securities (TIPS) – If stocks come under pressure, particularly due to a weakening global economy or the threat of a crisis in Europe, investors will likely continue to migrate to the relative safety of Treasury bonds. TIPS are up +7% so far in 2011 and Treasuries have been rallying since February and are already up +1% in the first few days of Q3. These positions have a generally short-term focus, however, particularly if the Fed starts talking about QE3 in the coming months.

Non-Financial Preferred Stocks – These are essentially bonds from electric utilities that trade like stocks on an exchange. They have yields in the range of 6% to 8% and have performed well both during periods of market calm as well as when the market has entered into pullback and even crisis phases.

Investment Grade Corporate Bonds – A consistently strong performing asset class regardless of whether stocks are in rally mode or in a pullback phase. Highlighting this point, the category is up roughly +40% since the beginning of the financial crisis while stocks are still working their way out of negative territory. Corporations are flush with cash, which bodes well for future outperformance. However, if the situation currently brewing in Italy breaks out into another full-blown financial crisis, allocations here will likely be reduced or sold altogether until the dust settles.

High Quality Defensive Stocks – While the current outlook for stocks in general is currently poor, certain sectors are set to perform well. These include companies from the Food, Household Products and Utilities industries. Regardless of how the economy performs, people are still going to eat, use soap (at least we hope) and turn on the lights. Of course, just like with corporate bonds, if a full-blown crisis phase erupts even stock positions in these defensive industries will likely be exited until stability returns to markets.

So although stocks in general may come under pressure as we move through the summer, many other asset classes that even includes some selected stock industries are set to perform well.

It promises to be an interesting summer for investment markets, and I will keep you updated along the way.

The Fed’s stimulus program – known as QE2 – came to an end on June 30. The idea behind the Fed’s effort was to provide support to the U.S. economy until it had recovered enough to stand on its own. Back in April 2010, investors had their first opportunity to look behind the market curtain when QE1 came to an end. And they did not like what they had found. The economy remained far too weak and the threat of another financial crisis was emanating from Europe. Stocks quickly plunged as a result. But unlike in the Wizard of Oz, the curtain was quickly pulled shut with the introduction of QE2. The message from the Fed – come back a year from now in June 2011 and the magical economy you’ve been waiting for will finally be here.

Upon drawing the curtain back a second time in July 2011, investors are still not bound to like what they’ve found. The economic recovery remains sluggish with job creation over the last few months all but stalled. The urgency of the crisis in Europe has spread from smaller countries like Greece to much larger nations like Italy. And all the while the U.S. government is deadlocked in a debate over raising the debt ceiling, only adding to the uncertainty.

Stocks have been remarkably resilient to this point in the face of mounting risks. But for how much longer? The stock market has a lot of air under it, as strong gains over the last few years have been justified by expectations that the economy would eventually recover strongly enough to support it. Unfortunately, this has not been the case. And the Fed’s QE stimulus that has helped lift stocks higher to this point has now gone away. As a result, it could be a very difficult time for stocks in the coming months. And the same is true for industrial and agricultural commodities for all of the same reasons.

Fortunately, stocks are only one of many asset class categories available in investment markets to capture opportunity and generate strong returns. And a variety of asset classes have attractive prospects as we move on in the Post QE2 marketplace. I’ve provided a brief summary on each below.

Gold – Although the yellow metal has risen strongly for many years, further upside is likely as long as global economic instability persists and major currencies such as the U.S. dollar and the euro suffer from a lack of confidence.

U.S. Treasuries and Treasury Inflation Protected Securities (TIPS) – If stocks come under pressure, particularly due to a weakening global economy or the threat of a crisis in Europe, investors will likely continue to migrate to the relative safety of Treasury bonds. TIPS are up +7% so far in 2011 and Treasuries have been rallying since February and are already up +1% in the first few days of Q3. These positions have a generally short-term focus, however, particularly if the Fed starts talking about QE3 in the coming months.

Non-Financial Preferred Stocks – These are essentially bonds from electric utilities that trade like stocks on an exchange. They have yields in the range of 6% to 8% and have performed well both during periods of market calm as well as when the market has entered into pullback and even crisis phases.

Investment Grade Corporate Bonds – A consistently strong performing asset class regardless of whether stocks are in rally mode or in a pullback phase. Highlighting this point, the category is up roughly +40% since the beginning of the financial crisis while stocks are still working their way out of negative territory. Corporations are flush with cash, which bodes well for future outperformance. However, if the situation currently brewing in Italy breaks out into another full-blown financial crisis, allocations here will likely be reduced or sold altogether until the dust settles.

High Quality Defensive Stocks – While the current outlook for stocks in general is currently poor, certain sectors are set to perform well. These include companies from the Food, Household Products and Utilities industries. Regardless of how the economy performs, people are still going to eat, use soap (at least we hope) and turn on the lights. Of course, just like with corporate bonds, if a full-blown crisis phase erupts even stock positions in these defensive industries will likely be exited until stability returns to markets.

So although stocks in general may come under pressure as we move through the summer, many other asset classes that even includes some selected stock industries are set to perform well.

It promises to be an interesting summer for investment markets, and I will keep you updated along the way.

This post is for information purposes only. There are risks involved with investing including loss of principal. Gerring Wealth Management (GWM) makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections made by GWM. There is no guarantee that the goals of the strategies discussed by GWM will be met.

Friday, June 24, 2011

Greece

Investment markets will be coping with the threat of crisis early next week. On Tuesday, the Greek parliament is set to vote on a new austerity program that is required for the country to receive the latest round of bailout funds from international creditors. While the approval of this vote remains the probable outcome, the failure to pass these measures could result in a severely negative reaction from investment markets. As a result, maintaining a close watch on portfolio risks and working to capture any potential opportunities will be particularly important over the coming days.

The situation in Greece remains critical. This is due to the fact that the country has billions in debt and interest payments coming due in July, and they don’t have the money to make these payments. As a result, Greece needs the latest round of bailout funds totaling 12 billion euros from the European Union (EU) and the International Monetary Fund (IMF) in order to avoid bankruptcy. The key to getting these funds is the austerity vote on Tuesday. If the Greek parliament fails to pass this latest round of budget cuts and tax hikes, the EU and IMF have stated they would withhold disbursing these funds.

If Greece were to default on its debts, it has the potential to spark a market crisis similar to the Lehman collapse in 2008. While Greece itself is relatively small, a key risk associated with a Greek default is the uncertainty over exactly what financial institutions are exposed to the resulting final losses and to what degree. European banks would be particularly at risk, and the spillover effects could impact U.S. banks as well.

Given this crisis risk, it is important to determine how portfolios can be allocated to both sidestep any potential chaos and capture upside opportunity. The following are the asset classes that would be poised to gain in the event of a new crisis emanating from the Euro Zone:

U.S. Treasuries

U.S. Treasury Inflation Protected Securities (TIPS)

Gold

Non-Financial Preferred Stocks

Fortunately, portfolio allocations are already heavily emphasizing these asset classes. This is due to the fact that the U.S. Federal Reserve’s latest stimulus program known as QE2 is set to end on Thursday just two days after the Greek parliamentary vote. And all of the categories listed above are also among those expected to perform best once QE2 comes to an end. As a result, portfolio allocations have already been shifted toward these asset classes well in advance of current events. One additional point - while positions such as Gold continue to represent long-term investments, other allocations like U.S. Treasuries are more likely to remain in place for the short-term until current risk conditions start to fade.

In the end, it is probable that the Greek parliament will end up passing these austerity measures and will push their debt problem down the road a few more months. But “probable” is far from “certain”, so monitoring these events closely through the weekend and into early next week will be important. I’ll keep you updated.

And with the end of the quarter coming on Thursday, I’ll also be checking back soon with a preview for what we can expect in the upcoming third quarter of 2011.

The situation in Greece remains critical. This is due to the fact that the country has billions in debt and interest payments coming due in July, and they don’t have the money to make these payments. As a result, Greece needs the latest round of bailout funds totaling 12 billion euros from the European Union (EU) and the International Monetary Fund (IMF) in order to avoid bankruptcy. The key to getting these funds is the austerity vote on Tuesday. If the Greek parliament fails to pass this latest round of budget cuts and tax hikes, the EU and IMF have stated they would withhold disbursing these funds.

If Greece were to default on its debts, it has the potential to spark a market crisis similar to the Lehman collapse in 2008. While Greece itself is relatively small, a key risk associated with a Greek default is the uncertainty over exactly what financial institutions are exposed to the resulting final losses and to what degree. European banks would be particularly at risk, and the spillover effects could impact U.S. banks as well.

Given this crisis risk, it is important to determine how portfolios can be allocated to both sidestep any potential chaos and capture upside opportunity. The following are the asset classes that would be poised to gain in the event of a new crisis emanating from the Euro Zone:

U.S. Treasuries

U.S. Treasury Inflation Protected Securities (TIPS)

Gold

Non-Financial Preferred Stocks

Fortunately, portfolio allocations are already heavily emphasizing these asset classes. This is due to the fact that the U.S. Federal Reserve’s latest stimulus program known as QE2 is set to end on Thursday just two days after the Greek parliamentary vote. And all of the categories listed above are also among those expected to perform best once QE2 comes to an end. As a result, portfolio allocations have already been shifted toward these asset classes well in advance of current events. One additional point - while positions such as Gold continue to represent long-term investments, other allocations like U.S. Treasuries are more likely to remain in place for the short-term until current risk conditions start to fade.

In the end, it is probable that the Greek parliament will end up passing these austerity measures and will push their debt problem down the road a few more months. But “probable” is far from “certain”, so monitoring these events closely through the weekend and into early next week will be important. I’ll keep you updated.

And with the end of the quarter coming on Thursday, I’ll also be checking back soon with a preview for what we can expect in the upcoming third quarter of 2011.

This post is for information purposes only. There are risks involved with investing including loss of principal. Gerring Wealth Management makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections made by GWM. There is no guarantee that the goals of the strategies discussed by GWM will be met.

Saturday, June 11, 2011

June Swoon

The post QE2 stock market correction is now underway. Although the U.S. Federal Reserve’s stimulus plan is not set to end until June 30, a definitive move to the exits in stocks has already begun on June 1. This shift lower in stocks in advance of the end of QE2 has long been expected, and the good news is that many other asset classes beyond stocks are filling the void with solid results.

Stocks are down over -5% thus far in June. While a snapback rally cannot be ruled out over the next few weeks with a final $56 billion dose of Fed stimulus still on its way between now and June 30, the breakdown in several fundamental, technical and behavioral indicators suggest that the recent downturn in stocks will likely have much further to go as we move through the summer:

The Economy:

Recent readings on the U.S. economy have been increasingly weak, which does not bode well for stocks in an environment where stimulus is about to disappear. In addition, the situation in Greece continues to deteriorate, with potential fallout effects that could impact both the European and global economy.

Technical Chart Patterns:

During the entire QE2 rally since last August, stocks had been firmly holding various support levels. But since the beginning of June, stocks have been cutting like a hot knife through many of these important support levels including its 50-day, 100-day and 150-day moving averages and its previous low on April 18. While several levels of major support still exist including the 200-day moving average and the March 16 lows, it has been notable how decisively the market has plunged through previously bulletproof support levels over the course of just a few days in June.

1st Day of the Month Effect:

Since the aftermath of the financial crisis, stocks have typically rallied on the first day of the month. For example, stocks have risen by nearly +1% on average on the first day of the month since the Fed launched QE2 last year. This trend is driven by mechanical reasons including the flow of retirement plan money into the market as well as sentiment factors such as portfolio managers positioning for return opportunities to start the new month. On June 1, stocks dropped by -2.28%, signaling investor concern about the outlook.

1st Day of the Week Effect:

Over the same time frame, stocks have also tended to perform well on the first day of the week. Sometimes referred to as Mutual Fund Monday, this effect is driven by capital flows into mutual funds that are put to work in the market on Mondays. Although this indicator has been deteriorating for months, the -1.08% decline on June 6 was one of the worst Monday outings for stocks in a QE supported market. This coupled with the fact that volume was notably low indicates reluctance by mutual fund managers to put fresh cash to work in stocks.

Bernanke Effect:

Since the beginning of the QE era in March 2009, stocks have typically rallied when the Fed Chairman makes a major speech. Even if he says nothing of consequence, stock investors have usually found a way of gleaning something positive from his words to rally higher. But when the Fed chairman took the podium on Tuesday, June 7, markets immediately rolled over and dropped by nearly -1% in about an hour. Once again, this price movement had little to do with anything Bernanke said – much of his speech had already been leaked into the market earlier in the day. Instead, this market response was likely a signal to the Chairman of investor concern that without more Fed stimulus (QE3), stocks will lack the fuel to continue to rally higher.

It has been expected for some time that stocks would begin to weaken in anticipation of the end of QE2 on June 30. And portfolio allocations have been adjusted for months in preparation for this eventual turn in stocks.

Many of the asset class categories that are expected to perform well during a Post QE2 stock market correction are off to a good start. Leading among these are U.S. Treasuries, which are up nearly +1% for the month. Selected non-financial preferred stocks have also jumped roughly +1%. In addition, Treasury Inflation Protected Securities (TIPS) are up +0.5% in June, while other categories such as Investment Grade Corporate Bonds and Gold are holding steady near breakeven so far for the month.

Looking ahead to the coming week, the next few trading days will be important in signaling whether one last rally in stocks is coming before QE2 draws to a close on June 30. Otherwise, the pace could begin to pick up to the downside. Stay tuned.

Stocks are down over -5% thus far in June. While a snapback rally cannot be ruled out over the next few weeks with a final $56 billion dose of Fed stimulus still on its way between now and June 30, the breakdown in several fundamental, technical and behavioral indicators suggest that the recent downturn in stocks will likely have much further to go as we move through the summer:

The Economy:

Recent readings on the U.S. economy have been increasingly weak, which does not bode well for stocks in an environment where stimulus is about to disappear. In addition, the situation in Greece continues to deteriorate, with potential fallout effects that could impact both the European and global economy.

Technical Chart Patterns:

During the entire QE2 rally since last August, stocks had been firmly holding various support levels. But since the beginning of June, stocks have been cutting like a hot knife through many of these important support levels including its 50-day, 100-day and 150-day moving averages and its previous low on April 18. While several levels of major support still exist including the 200-day moving average and the March 16 lows, it has been notable how decisively the market has plunged through previously bulletproof support levels over the course of just a few days in June.

1st Day of the Month Effect:

Since the aftermath of the financial crisis, stocks have typically rallied on the first day of the month. For example, stocks have risen by nearly +1% on average on the first day of the month since the Fed launched QE2 last year. This trend is driven by mechanical reasons including the flow of retirement plan money into the market as well as sentiment factors such as portfolio managers positioning for return opportunities to start the new month. On June 1, stocks dropped by -2.28%, signaling investor concern about the outlook.

1st Day of the Week Effect:

Over the same time frame, stocks have also tended to perform well on the first day of the week. Sometimes referred to as Mutual Fund Monday, this effect is driven by capital flows into mutual funds that are put to work in the market on Mondays. Although this indicator has been deteriorating for months, the -1.08% decline on June 6 was one of the worst Monday outings for stocks in a QE supported market. This coupled with the fact that volume was notably low indicates reluctance by mutual fund managers to put fresh cash to work in stocks.

Bernanke Effect:

Since the beginning of the QE era in March 2009, stocks have typically rallied when the Fed Chairman makes a major speech. Even if he says nothing of consequence, stock investors have usually found a way of gleaning something positive from his words to rally higher. But when the Fed chairman took the podium on Tuesday, June 7, markets immediately rolled over and dropped by nearly -1% in about an hour. Once again, this price movement had little to do with anything Bernanke said – much of his speech had already been leaked into the market earlier in the day. Instead, this market response was likely a signal to the Chairman of investor concern that without more Fed stimulus (QE3), stocks will lack the fuel to continue to rally higher.

It has been expected for some time that stocks would begin to weaken in anticipation of the end of QE2 on June 30. And portfolio allocations have been adjusted for months in preparation for this eventual turn in stocks.

Many of the asset class categories that are expected to perform well during a Post QE2 stock market correction are off to a good start. Leading among these are U.S. Treasuries, which are up nearly +1% for the month. Selected non-financial preferred stocks have also jumped roughly +1%. In addition, Treasury Inflation Protected Securities (TIPS) are up +0.5% in June, while other categories such as Investment Grade Corporate Bonds and Gold are holding steady near breakeven so far for the month.

Looking ahead to the coming week, the next few trading days will be important in signaling whether one last rally in stocks is coming before QE2 draws to a close on June 30. Otherwise, the pace could begin to pick up to the downside. Stay tuned.

Tuesday, May 31, 2011

Looking Beyond QE2

The post QE2 path for the economy and markets is becoming increasingly clear. It was known from the beginning when the U.S. Federal Reserve’s launched its current $600 billion stimulus program late last year (widely known as “the second round of quantitative easing” or QE2) that it would come down to two possible outcomes in the end.

The ideal outcome: Economic growth picks up and becomes strong enough to support asset prices inflated by Fed stimulus along the way including stocks and commodities. In other words, the economy would eventually grow up to support higher markets.

The deficient outcome: Economic growth remains sluggish despite Fed stimulus, placing inflated stock and commodities prices at risk for a meaningful pullback. More simply, higher markets are left to fall back to the weak economy.

As we enter the final days before the end of QE2 on June 30, it is becoming increasingly clear that the deficient outcome will be the most likely. Recent U.S. economic data has been disappointing to say the least. Not only is the pace of growth sluggish at best, the economy is actually showing signs of slowing down with many readings coming in below expectations. Beyond the U.S., the economic situation in Europe remains no better than it was a year ago at this time. Instead, it is actually quite a bit worse.

With the deficient outcome most likely after QE2, what can we expect from markets?

First, stocks and commodities are likely to enjoy at least one more rally in the days leading up to the end of QE2 regardless of the fundamentals. Today was another classic example of what we’ve seen throughout QE2. Despite a day filled with lousy U.S. economic data, stocks rallied sharply higher on the news that Greece was set to receive another bailout and would avoid bankruptcy - for now. No matter that Greece will simply be unable to repay its debts - they already can’t pay their current loans back, so lending them even more money isn’t going to solve the problem. But while a market that can celebrate the can being kicked further down the road is certainly dubious, it does provide an ideal environment to gradually transition portfolios into the expected post QE2 winners.

So which categories are these expected winners. They are listed below:

Likely post QE2 winners:

Selected Defensive U.S. Large Cap Growth Stocks

Selected Defensive U.S. Mid-Cap Growth Stocks

Gold

Investment Grade Corporate Bonds

High Yield Corporate Bonds

Non-Financial Preferred Stocks

U.S. Treasuries

This list comes with precedent - all of these categories either held steady or posted solid gains when the deficient outcome occurred after the end of QE1 last summer. And many if not all are set up well to repeat this performance a second time around.

Of course, many market segments are likely to struggle under the deficient outcome. The list of likely post QE2 losers are shown below (many of these have been winners in the current environment):

Likely post QE2 losers:

Most U.S. Stock categories – Cyclicals and Financials in particular

International Stocks

Emerging Market Stocks

Industrial Commodities – Copper, Oil, etc.

Agricultural Commodities

Financial Preferred Stocks

Non-US Sovereign Bonds

Emerging Market Bonds

What about the wild cards? Preparing for the unexpected is critical, particularly in today’s markets. While there are too many to mention in this e-mail, two particular events bear close watching in the coming months after QE2. The first is the arrival of QE3 – just as they did last summer, the Fed could eventually step back in with another round of stimulus. This would be a signal to potentially shift allocations back to the current “post QE2 loser” list. The second is the situation in Europe – if things begin to really come apart in the Euro Zone, this would be a potential shock that could narrow and change the “post QE2 winner” list above quite a bit. Stay tuned on both of these items – I’ll keep you updated.

The priority over the last several weeks and continuing in the coming weeks will be to gradually shift allocations away from the expected post QE2 losers and reallocate toward the anticipated post QE2 winners. Closely monitoring the potential wild cards will also be important along the way. Through it all, the focus remains on generating positive absolute returns, managing risk and seeking to capitalize on positive return opportunities regardless of the overall market environment.

The ideal outcome: Economic growth picks up and becomes strong enough to support asset prices inflated by Fed stimulus along the way including stocks and commodities. In other words, the economy would eventually grow up to support higher markets.

The deficient outcome: Economic growth remains sluggish despite Fed stimulus, placing inflated stock and commodities prices at risk for a meaningful pullback. More simply, higher markets are left to fall back to the weak economy.

As we enter the final days before the end of QE2 on June 30, it is becoming increasingly clear that the deficient outcome will be the most likely. Recent U.S. economic data has been disappointing to say the least. Not only is the pace of growth sluggish at best, the economy is actually showing signs of slowing down with many readings coming in below expectations. Beyond the U.S., the economic situation in Europe remains no better than it was a year ago at this time. Instead, it is actually quite a bit worse.

With the deficient outcome most likely after QE2, what can we expect from markets?

First, stocks and commodities are likely to enjoy at least one more rally in the days leading up to the end of QE2 regardless of the fundamentals. Today was another classic example of what we’ve seen throughout QE2. Despite a day filled with lousy U.S. economic data, stocks rallied sharply higher on the news that Greece was set to receive another bailout and would avoid bankruptcy - for now. No matter that Greece will simply be unable to repay its debts - they already can’t pay their current loans back, so lending them even more money isn’t going to solve the problem. But while a market that can celebrate the can being kicked further down the road is certainly dubious, it does provide an ideal environment to gradually transition portfolios into the expected post QE2 winners.

So which categories are these expected winners. They are listed below:

Likely post QE2 winners:

Selected Defensive U.S. Large Cap Growth Stocks

Selected Defensive U.S. Mid-Cap Growth Stocks

Gold

Investment Grade Corporate Bonds

High Yield Corporate Bonds

Non-Financial Preferred Stocks

U.S. Treasuries

This list comes with precedent - all of these categories either held steady or posted solid gains when the deficient outcome occurred after the end of QE1 last summer. And many if not all are set up well to repeat this performance a second time around.

Of course, many market segments are likely to struggle under the deficient outcome. The list of likely post QE2 losers are shown below (many of these have been winners in the current environment):

Likely post QE2 losers:

Most U.S. Stock categories – Cyclicals and Financials in particular

International Stocks

Emerging Market Stocks

Industrial Commodities – Copper, Oil, etc.

Agricultural Commodities

Financial Preferred Stocks

Non-US Sovereign Bonds

Emerging Market Bonds

What about the wild cards? Preparing for the unexpected is critical, particularly in today’s markets. While there are too many to mention in this e-mail, two particular events bear close watching in the coming months after QE2. The first is the arrival of QE3 – just as they did last summer, the Fed could eventually step back in with another round of stimulus. This would be a signal to potentially shift allocations back to the current “post QE2 loser” list. The second is the situation in Europe – if things begin to really come apart in the Euro Zone, this would be a potential shock that could narrow and change the “post QE2 winner” list above quite a bit. Stay tuned on both of these items – I’ll keep you updated.

The priority over the last several weeks and continuing in the coming weeks will be to gradually shift allocations away from the expected post QE2 losers and reallocate toward the anticipated post QE2 winners. Closely monitoring the potential wild cards will also be important along the way. Through it all, the focus remains on generating positive absolute returns, managing risk and seeking to capitalize on positive return opportunities regardless of the overall market environment.

This post is for information purposes only. There are risks involved with investing including loss of principal. Gerring Wealth Management (GWM) makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections made by GWM. There is no guarantee that the goals of the strategies discussed by GWM will be met.

Tuesday, May 17, 2011

2011 Q2 Mid Quarter Update: Anticipating the End of QE2

Investment markets have pretty much followed the script so far in 2011 Q2. Many of the risks that were hanging over the market at the beginning of April are still lingering. The situation in the Middle East is far from resolved and the U.S. economic outlook remains muddled at best. And some risks have risen to the next level. Leading among these is the deteriorating situation in Europe. Not only is the risk for default in places like Ireland and Portugal continuing to rise, but rumors even bubbled to the surface that Greece was threatening to leave the Euro Zone altogether. But just as before, investment markets have continued to largely ignore these ongoing risks so far in Q2. Instead, the focus remains almost exclusively on QE2, the Fed’s stimulus program that’s set to end on June 30.

Since QE2 is such a key driver for the markets, a few important questions are worth considering. First, what can we expect from investment markets in the final weeks before the end of QE2 on June 30? Second, how will investment markets react starting in early July once QE2 is finished? Finally, what is the likelihood that the Fed will return with another round of stimulus (QE3) at some point later in the year?

To answer the first two questions, it’s worthwhile to examine the market by asset class:

Stocks – The steady rise in stocks that started with the launch of QE2 last year is becoming replaced by swinging volatility as we approach the end of QE2. While stocks remain in an uptrend and reached a new post crisis high as recently as May 2, they are clearly losing steam. Short-term corrections are also becoming more frequent and violent, suggesting a shift to the downside for stocks may soon be on its way. Dissecting the stock market into its sector components is even more revealing. When QE2 was launched last August, the more cyclical sectors including industrials, retailers and commodities were the market leaders. But since the beginning of the second quarter, investors have fled these more economically sensitive areas in favor of more defensive sectors such as consumer staples, utilities and health care. This type of sector rotation from cyclical to defensive sectors is also common during the late stages of a stock rally. Portfolios benefitted from having a defensive stock emphasis heading into this shift, but many of these sectors are now starting to become a bit frothy in their own right. As a result, individual stock selection will become increasingly important in generating returns and protecting against risk as we head into the post QE2 summer months, particularly if the broader stock market moves lower as expected.

High Yield Corporate Bonds – This “stocks-lite” asset class continues to post consistently strong performance. High yield bonds have also avoided the swings of volatility that have been increasingly disrupting the stock market. As mentioned in the past, companies that make up the high yield bond category are building cash reserves and paying down debt, which is positive for the sustainability of these upside returns going forward. High yield bonds also remain reasonably valued and provide a +6% yield to go along with the steady price appreciation. While high yield bonds are likely to experience a pullback to some degree following the end of QE2, they represent an ideal way to still maintain stock-like exposure in portfolios while also protecting against downside risk in what could be a turbulent summer for stocks.

Investment Grade Corporate Bonds – Put simply, investment grade corporate bonds are among the best investment choices in a post QE2 environment. Most big companies are flush with cash and are ready to make the interest payments on their debts. In addition, if the economy slows as expected once QE2 ends, investors will likely flock to the high quality yield provided by investment grade corporate bonds. Although a bit overbought at the moment, investment grade corporate bonds valuations still remain reasonable, and the price performance of this asset class has also been consistently higher since the early days following the financial crisis, steadily rising both when QE is on and when QE is off.

Preferred Stocks – While this asset class should be generally avoided due to the near 90% weighting to financials, selected high yielding preferred stocks in the telecom and utilities sector may set up for attractive short-term investment opportunities in the coming months, particularly once we get into the post QE2 summer months.

Silver – The silver mania peaked and came to an end in Q2. Portfolio gains were locked in near the peak of the silver market and downside volatility has become extreme in the aftermath. While the thesis behind holding silver remains in tact, trading in this category has become toxic and remains overrun by speculators. As a result, it is best to avoid the silver trade going forward and look for more stable opportunities elsewhere.

Gold – Unlike silver, gold continues to represent an attractive investment opportunity. Chronic U.S. dollar weakening is a key driver behind the rising gold price, and this theme remains in tact with the U.S. government and the Fed still actively engaged in programs to promote money printing and currency debasement. Secondary themes including the threat of a double dip recession and geopolitical instability in Europe and the Middle East also remain supportive of gold. And the frequent talk in the press about gold being in a bubble is misguided, as trading activity in gold has instead been both rational and predictable for the last several years. If anything, stocks are far more “bubbly” than gold at this point. While short-term corrections like the pullback since the beginning of May should be expected along the way, the trend for gold remains very much in place. The key level to watch for gold as we move through the post QE2 summer is the 150-day moving average, which is now at $1,404 per ounce but will continue to rise as we move through the summer. As long as gold remains above its 150-day moving average – it is currently trading at $1,486 per ounce - the gold theme remains in tact. On the other hand, if gold were to eventually break below it’s 150-day moving average on a sustained basis, it may then be the time to lock in gains. Updates will follow along the way.