The following is a link to article that I wrote that was posted to Seeking Alpha today

http://seekingalpha.com/article/260574-mcdonald-s-a-solid-long-term-and-post-qe2-investment

My bottom line from the article: McDonald’s represents at potentially attractive high quality equity portfolio position both for a post QE2 market as well as a core long-term holding. It also offers some appeal from a shorter-term trading perspective, although pullbacks toward the 200-day moving average may provide an even better entry point.

(This post is for information purposes only. There are risks involved with investing including loss of principal. Gerring Wealth Management (GWM) makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections made by GWM. There is no guarantee that the goals of the strategies discussed by GWM will be met.)

Tuesday, March 29, 2011

Thursday, March 24, 2011

A Day in the Life of a Fed Driven Market

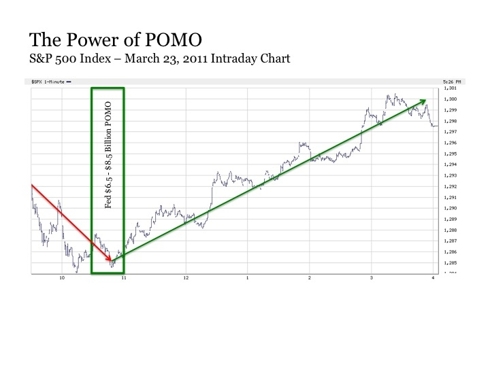

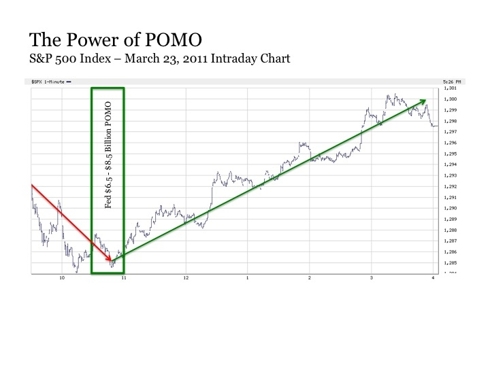

A review of the headlines heading into yesterday’s trading day on March 23, 2011 was notable.

* Portugal braces for government collapse over austerity vote

* Ireland’s 10-year bond yield hits record at over 10%

* Bombing in Israel bus station

* Yemen’s pro-U.S. leader in talks on exit

* U.S. new home sales lowest on record, prices fall to December 2003 levels

* Federal Reserve rejects Bank of America dividend raise

Investment markets do not like uncertainty. And on any normal trading day, simply one of these headlines alone might provide justification for stock investors to take pause and reevaluate risk exposures. So with six such major headlines in a single day, it would have been more than reasonable to expect that stocks might head lower for the trading session, as investors would be inclined to take some money of the table as they analyze the implications of some if not all of these events. And such risk aversion would be particularly prudent in a stock market that has nearly doubled since the March 2009 lows and has risen by over +30% in a virtual straight line since last summer.

When trade opened yesterday morning at 9:30AM, a pullback was exactly what we saw, as the market quickly dropped by roughly -1%. But once we entered the second hour of trading, the downward trend suddenly reversed. By 10:30AM, the market showed signs of bottoming. And through the remainder of the morning and the rest of the trading day, the market elevated steadily higher to end the day up +0.5%. The fact that the market ended up on a day when a variety of new and meaningful risks bubbled to the surface certainly raises an eyebrow. After all, whether it's to the upside or the downside, you want to make sure your in a market that is acting at least somewhat rationally.

Trading days just like yesterday have become all too familiar over the last few years – down at open on negative news, bottom mid morning, rally through the remainder of the day to end higher. This raises the obvious question – what is happening around 10:30AM that sparks this market resilience to shake off any and all signs of worry and start ascending higher? The answer – the U.S. Federal Reserve.

Nearly every trading day, the Fed conducts Permanent Open Market Operations (POMO) starting at 10:30AM as part of their latest $600 billion asset purchase plan widely known as “QE2”. Between 10:30AM and 11:00AM, the Fed buys anywhere between $5.5 billion to $8.5 billion in U.S. Treasury securities from financial institutions such as the major banks. So by late morning on any given trading day, we have financial institutions that suddenly have a load of cash that they just received from the Fed and now need to do something with it. And a good chunk of this money has been finding its way into investment markets including stocks, which helps ignite the reversal and propel stocks higher. In other words, the Fed has essentially become the marginal buyer of stocks through their Open Market Operations.

This process has two key implications going forward. First, the Fed’s QE2 is set to run through June 30, 2011. As long as QE2 is running – we are currently around $360 billion, or 60%, through QE2 through today with 98 calendar days left before June 30, 2011 – it is reason expect these mid-morning reversal up days will continue to occur with regularity regardless of what risks the world throws at it. Second, the daily marginal buyer for stocks is set to go away once QE2 ends. Thus, a day like yesterday that opens down but reverses and heads higher is likely to become a day that opens lower and accelerates to the downside as the day progresses. It is also worth noting that the infamous stock market flash crash occurred on May 6, 2010, just days after the Fed rounded out QE1 back in late April of last year. As a result, increase volatility should be expected post QE2 and such unpredictable flash crash episodes should not be ruled out either. In short, current imperviousness to risk may quickly become heightened sensitivity to risk once QE2 goes away.

The bottom line – there’s likely still time to ride the stock wave higher between now and June. But barring a dramatic economic acceleration or rumblings of QE3 in the coming months, investors will be wise to beware what might lie ahead for stocks in the aftermath of QE2.

(This post is for information purposes only. There are risks involved with investing including loss of principal. Gerring Wealth Management (GWM) makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections made by GWM. There is no guarantee that the goals of the strategies discussed by GWM will be met.)

* Portugal braces for government collapse over austerity vote

* Ireland’s 10-year bond yield hits record at over 10%

* Bombing in Israel bus station

* Yemen’s pro-U.S. leader in talks on exit

* U.S. new home sales lowest on record, prices fall to December 2003 levels

* Federal Reserve rejects Bank of America dividend raise

Investment markets do not like uncertainty. And on any normal trading day, simply one of these headlines alone might provide justification for stock investors to take pause and reevaluate risk exposures. So with six such major headlines in a single day, it would have been more than reasonable to expect that stocks might head lower for the trading session, as investors would be inclined to take some money of the table as they analyze the implications of some if not all of these events. And such risk aversion would be particularly prudent in a stock market that has nearly doubled since the March 2009 lows and has risen by over +30% in a virtual straight line since last summer.

When trade opened yesterday morning at 9:30AM, a pullback was exactly what we saw, as the market quickly dropped by roughly -1%. But once we entered the second hour of trading, the downward trend suddenly reversed. By 10:30AM, the market showed signs of bottoming. And through the remainder of the morning and the rest of the trading day, the market elevated steadily higher to end the day up +0.5%. The fact that the market ended up on a day when a variety of new and meaningful risks bubbled to the surface certainly raises an eyebrow. After all, whether it's to the upside or the downside, you want to make sure your in a market that is acting at least somewhat rationally.

Trading days just like yesterday have become all too familiar over the last few years – down at open on negative news, bottom mid morning, rally through the remainder of the day to end higher. This raises the obvious question – what is happening around 10:30AM that sparks this market resilience to shake off any and all signs of worry and start ascending higher? The answer – the U.S. Federal Reserve.

Nearly every trading day, the Fed conducts Permanent Open Market Operations (POMO) starting at 10:30AM as part of their latest $600 billion asset purchase plan widely known as “QE2”. Between 10:30AM and 11:00AM, the Fed buys anywhere between $5.5 billion to $8.5 billion in U.S. Treasury securities from financial institutions such as the major banks. So by late morning on any given trading day, we have financial institutions that suddenly have a load of cash that they just received from the Fed and now need to do something with it. And a good chunk of this money has been finding its way into investment markets including stocks, which helps ignite the reversal and propel stocks higher. In other words, the Fed has essentially become the marginal buyer of stocks through their Open Market Operations.

This process has two key implications going forward. First, the Fed’s QE2 is set to run through June 30, 2011. As long as QE2 is running – we are currently around $360 billion, or 60%, through QE2 through today with 98 calendar days left before June 30, 2011 – it is reason expect these mid-morning reversal up days will continue to occur with regularity regardless of what risks the world throws at it. Second, the daily marginal buyer for stocks is set to go away once QE2 ends. Thus, a day like yesterday that opens down but reverses and heads higher is likely to become a day that opens lower and accelerates to the downside as the day progresses. It is also worth noting that the infamous stock market flash crash occurred on May 6, 2010, just days after the Fed rounded out QE1 back in late April of last year. As a result, increase volatility should be expected post QE2 and such unpredictable flash crash episodes should not be ruled out either. In short, current imperviousness to risk may quickly become heightened sensitivity to risk once QE2 goes away.

The bottom line – there’s likely still time to ride the stock wave higher between now and June. But barring a dramatic economic acceleration or rumblings of QE3 in the coming months, investors will be wise to beware what might lie ahead for stocks in the aftermath of QE2.

(This post is for information purposes only. There are risks involved with investing including loss of principal. Gerring Wealth Management (GWM) makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections made by GWM. There is no guarantee that the goals of the strategies discussed by GWM will be met.)

Sunday, March 20, 2011

GWM Commentary - Summer Holds the Key

Events around the world have certainly been unsettling for investment markets in recent weeks. Political unrest in the Middle East, ongoing sovereign debt concerns in Europe and the tragic humanitarian crisis in Japan are just a few of the many influences that drove the stock market down by over -7% since late February.

Given the ongoing uncertainties tied to many of these events, it is reasonable to consider whether this recent pullback represents the beginning of a more prolonged downturn in the stock market. The most likely answer – no, at least not yet.

The key factor has been driving investment markets over the last two years has been the unprecedentedly aggressive stimulus efforts from the U.S. Federal Reserve known as “Quantitative Easing” or “QE”. The Fed pumped $1.6 trillion in to the markets from March 2009 to April 2010 to rescue the economy from the financial crisis (QE1). And it stepped in with another $600 billion for markets starting in November 2010 to keep the economy from falling back into recession (QE2). As long as the Fed continues to pump stimulus into the system, investment markets including stocks are likely to have the support to hold their ground and resume moving higher, regardless of what happens politically or economically around the world. However, increasing market choppiness should be expected from here.

Through today, the Fed has deployed $332 billion under its current program and plans to distribute the remaining $268 billion by the end of June 2011. Therefore, we have a little over three months left before the Fed’s QE2 program comes to an end.

This leads to the key question. What will happen when QE2 is over at the end of June? An important clue is provided by what happened when the Fed ended QE1 back in April 2010. Immediately after the Fed stepped aside the first time around, the stock market plunged by -17% in just 10 weeks. And stocks would have likely fallen further had the Fed not stepped in starting in July 2010 with explicit signals that they would soon be implementing QE2 by Fall 2010.

Can we expect the same outcome at the end of QE2 in June 2011? The most likely answer – yes. The economy is simply not strong enough to fill the market void once the Fed stimulus goes away.

An important difference can be expected this time around – the market decline began literally as QE1 came to an end, but the market will now be anticipating this decline the second time around. As a result, we should expect stocks to begin to move lower at least a few weeks before the end of QE2 if not more.

So what’s the best way to position for the end of QE2? Many asset classes held up well and continued to rise following the end of QE1. These included TIPS, Investment Grade Corporate Bonds, High Yield Corporate Bonds and Gold. US Treasuries, the US Dollar and Volatility also rallied last summer after QE1 ended. An emphasis on these asset classes is likely to remain worthwhile the next time around. In addition, a focus on select high quality stocks, particularly in the Consumer Staples and Utilities sectors, was also rewarded after the end of QE1 and many of these stocks remain attractively valued today. I have been and will continue to shift investment strategies toward some of these categories and positions in the coming weeks and months as opportunities present themselves.

I will be checking back periodically with future commentaries on this topic as events unfold between now and the end of QE2 in June 2011.

Eric Parnell

Gerring Wealth Management

The contents are provided for information purposes only.

There are risks involved with investing including loss of principal. GWM

makes no explicit or implicit guarantee with respect to performance or the

outcome of any investment or projections made by GWM. There is no guarantee

that the goals of the strategies implemented will be met.

Given the ongoing uncertainties tied to many of these events, it is reasonable to consider whether this recent pullback represents the beginning of a more prolonged downturn in the stock market. The most likely answer – no, at least not yet.

The key factor has been driving investment markets over the last two years has been the unprecedentedly aggressive stimulus efforts from the U.S. Federal Reserve known as “Quantitative Easing” or “QE”. The Fed pumped $1.6 trillion in to the markets from March 2009 to April 2010 to rescue the economy from the financial crisis (QE1). And it stepped in with another $600 billion for markets starting in November 2010 to keep the economy from falling back into recession (QE2). As long as the Fed continues to pump stimulus into the system, investment markets including stocks are likely to have the support to hold their ground and resume moving higher, regardless of what happens politically or economically around the world. However, increasing market choppiness should be expected from here.

Through today, the Fed has deployed $332 billion under its current program and plans to distribute the remaining $268 billion by the end of June 2011. Therefore, we have a little over three months left before the Fed’s QE2 program comes to an end.

This leads to the key question. What will happen when QE2 is over at the end of June? An important clue is provided by what happened when the Fed ended QE1 back in April 2010. Immediately after the Fed stepped aside the first time around, the stock market plunged by -17% in just 10 weeks. And stocks would have likely fallen further had the Fed not stepped in starting in July 2010 with explicit signals that they would soon be implementing QE2 by Fall 2010.

Can we expect the same outcome at the end of QE2 in June 2011? The most likely answer – yes. The economy is simply not strong enough to fill the market void once the Fed stimulus goes away.

An important difference can be expected this time around – the market decline began literally as QE1 came to an end, but the market will now be anticipating this decline the second time around. As a result, we should expect stocks to begin to move lower at least a few weeks before the end of QE2 if not more.

So what’s the best way to position for the end of QE2? Many asset classes held up well and continued to rise following the end of QE1. These included TIPS, Investment Grade Corporate Bonds, High Yield Corporate Bonds and Gold. US Treasuries, the US Dollar and Volatility also rallied last summer after QE1 ended. An emphasis on these asset classes is likely to remain worthwhile the next time around. In addition, a focus on select high quality stocks, particularly in the Consumer Staples and Utilities sectors, was also rewarded after the end of QE1 and many of these stocks remain attractively valued today. I have been and will continue to shift investment strategies toward some of these categories and positions in the coming weeks and months as opportunities present themselves.

I will be checking back periodically with future commentaries on this topic as events unfold between now and the end of QE2 in June 2011.

Eric Parnell

Gerring Wealth Management

The contents are provided for information purposes only.

There are risks involved with investing including loss of principal. GWM

makes no explicit or implicit guarantee with respect to performance or the

outcome of any investment or projections made by GWM. There is no guarantee

that the goals of the strategies implemented will be met.

Friday, March 18, 2011

More on QE Proof Stocks for Summer 2011

"They are like a person building a house, who dug down deep and laid the foundation on rock. When a flood came, the torrent struck that house but could not shake it, because it was well built" -Luke 6:48

In my recent posts, I discussed the dependence of stocks on Quantitative Easing (QE) from the Federal Reserve and identified a group of high quality stocks that overcame the downdraft that afflicted the overall equity market following the end of QE1 from April 2010 to August 2010. I will be back soon with a look at asset classes outside of the equity market. In the meantime, I wanted to revisit the stock discussion still looking ahead to the projected end of QE2 on June 30, 2011.

Quality, size and stability will likely be critical factors to consider for stocks when QE finally comes to an end.

As a recap, the S&P 500 Index plunged over -17% in a matter of weeks following the end of QE1 in April 2010. In my previous post, QE-Proof Stocks for Summer 2011, I identified 19 stocks that performed relatively well during this "QE Pause" from April 26, 2010 to August 27, 2010 when the Fed definitively announced that QE2 was on its way. Stocks were selected on the following critera:

Size - Member of the S&P 500 Index (US Large Caps held up considerably better than Mid-Caps, Small Caps and Non-US Stocks)

Quality - S&P Quality Ranking of A- or better

Stability - Cumulative closing price decline during the the QE Pause period from April 26, 2010 to August 27, 2010 of less than -10% and Intraday price decline of less than -11%

To expand on this analysis, I wanted to subject the Quality constraint to further tests. After all, there are 375 stocks in the S&P 500 Index that have a S&P Quality Ranking of B+ or lower.

What was notable in this analysis is that very few stocks beyond the high quality universe held up during the QE Pause. Overall, only 14 stocks out of the remaining 375 in the S&P 500 Index met the Stability criteria. I have listed these below, as I've added them to my original list of 19.

Marathon Oil (MRO)

Stericycle (SRCL)

Auto Zone (AZO)

O'Reilly Automotive (ORLY)

HJ Heinz (HNZ)

Dr. Pepper Snapple (DPS)

Reynolds American (RAI)

Progressive (PGR)

Intuit (INTU)

AT&T (T)

Dominion Resources (D)

Consolidated Edison (ED)

Xcel Energy (XEL)

A few things are notable about this list. First, 11 of the 14 listed above have an S&P Quality Ranking of B+, which is the highest possible quality ranking for those stocks not included in the original list of 19. This reinforces the importance of quality in a non-QE environment.

What is also notable, although less surprising, is the defensive nature of the names on the combined list of 33 stocks. More specifically, 14 names are from the Consumer Staples sector and another 6 stocks are from the Utilities sector. With over 60% of stocks coming from two sectors, it is also worthwhile to consider the Sector ETFs in this context. A look at the Consumer Staples Select Sector SPDR (XLP) and Utilities Select Sector SPDR (XLU) show that both also meet the Stability criteria outlined above.

So how well did these quality stocks perform following the end of QE1? The chart below shows the cumulative performance of an equal weighted portfolio of the 33 stocks identified versus the overall S&P 500 Index. Overall, while the S&P 500 Index experienced a maximum decline of -17% and was still down -15% by the end of August, the equal weighted 33 stock portfolio experienced a maximum decline of only -3% in generating a +4% advance during the same period.

Of course, history will not necessarily repeat itself with these 33 stocks when QE2 comes to an end. While some will hold up again the second time around, others will likely falter due to new forces at work. And some stocks that trailed after QE1 will shine following QE2. So while the individual names may differ the next time around, the overall focus on quality, size and stability in stock portfolios provides the ability to protect capital with greater probability once QE2 comes to an end.

In my recent posts, I discussed the dependence of stocks on Quantitative Easing (QE) from the Federal Reserve and identified a group of high quality stocks that overcame the downdraft that afflicted the overall equity market following the end of QE1 from April 2010 to August 2010. I will be back soon with a look at asset classes outside of the equity market. In the meantime, I wanted to revisit the stock discussion still looking ahead to the projected end of QE2 on June 30, 2011.

Quality, size and stability will likely be critical factors to consider for stocks when QE finally comes to an end.

As a recap, the S&P 500 Index plunged over -17% in a matter of weeks following the end of QE1 in April 2010. In my previous post, QE-Proof Stocks for Summer 2011, I identified 19 stocks that performed relatively well during this "QE Pause" from April 26, 2010 to August 27, 2010 when the Fed definitively announced that QE2 was on its way. Stocks were selected on the following critera:

Size - Member of the S&P 500 Index (US Large Caps held up considerably better than Mid-Caps, Small Caps and Non-US Stocks)

Quality - S&P Quality Ranking of A- or better

Stability - Cumulative closing price decline during the the QE Pause period from April 26, 2010 to August 27, 2010 of less than -10% and Intraday price decline of less than -11%

To expand on this analysis, I wanted to subject the Quality constraint to further tests. After all, there are 375 stocks in the S&P 500 Index that have a S&P Quality Ranking of B+ or lower.

What was notable in this analysis is that very few stocks beyond the high quality universe held up during the QE Pause. Overall, only 14 stocks out of the remaining 375 in the S&P 500 Index met the Stability criteria. I have listed these below, as I've added them to my original list of 19.

Marathon Oil (MRO)

Stericycle (SRCL)

Auto Zone (AZO)

O'Reilly Automotive (ORLY)

HJ Heinz (HNZ)

Dr. Pepper Snapple (DPS)

Reynolds American (RAI)

Progressive (PGR)

Intuit (INTU)

AT&T (T)

Dominion Resources (D)

Consolidated Edison (ED)

Xcel Energy (XEL)

A few things are notable about this list. First, 11 of the 14 listed above have an S&P Quality Ranking of B+, which is the highest possible quality ranking for those stocks not included in the original list of 19. This reinforces the importance of quality in a non-QE environment.

What is also notable, although less surprising, is the defensive nature of the names on the combined list of 33 stocks. More specifically, 14 names are from the Consumer Staples sector and another 6 stocks are from the Utilities sector. With over 60% of stocks coming from two sectors, it is also worthwhile to consider the Sector ETFs in this context. A look at the Consumer Staples Select Sector SPDR (XLP) and Utilities Select Sector SPDR (XLU) show that both also meet the Stability criteria outlined above.

So how well did these quality stocks perform following the end of QE1? The chart below shows the cumulative performance of an equal weighted portfolio of the 33 stocks identified versus the overall S&P 500 Index. Overall, while the S&P 500 Index experienced a maximum decline of -17% and was still down -15% by the end of August, the equal weighted 33 stock portfolio experienced a maximum decline of only -3% in generating a +4% advance during the same period.

Of course, history will not necessarily repeat itself with these 33 stocks when QE2 comes to an end. While some will hold up again the second time around, others will likely falter due to new forces at work. And some stocks that trailed after QE1 will shine following QE2. So while the individual names may differ the next time around, the overall focus on quality, size and stability in stock portfolios provides the ability to protect capital with greater probability once QE2 comes to an end.

Thursday, March 10, 2011

QE Proof Stocks for Summer 2011

"To be interested in the changing seasons is a happier state of mind than to be hopelessly in love with spring" -George Santayana

Whether the Fed will actually follow through with ending QE2 at the end of June will remain a subject for debate in the next few months. But holding the Fed to their recent word, the time is now to look ahead and try to determine which investments might hold up best once QE2 is over.

When the Fed ended QE1 in Spring 2010, the stock market immediately dropped -17% in a matter of weeks. Seeking to avoid this type of downside volatility post QE2 in the second half of 2011, I went searching for those stocks that performed well through the last "QE Pause" during Summer 2010.

My search criteria was the following. First, I focused my search on quality stocks - if QE2 is going to end with a global economy still on shaky footing, I'd like to hold the companies that are set up to weather any pending storm best. I used the S&P 500 High Quality Rankings Index to provide me with my candidate stock list. Next, I focused my analysis on the period from April 26, 2010 when stocks peaked at the end of QE1 to August 27, 2010 when Fed Chairman Ben Bernanke confirmed that QE2 was on its way in his Jackson Hole speech and the stock rally started anew. Finally, I screened the universe for stocks that experienced only short and limited declines during this stretch (-11% or less) and maintained upward price momentum throughout this time period. Out of the 125 in the universe, I was left with a list of 19 stocks, which I've listed below.

Ecolab (ECL)

McDonald's (MCD)

Hasbro (HAS)

Brown & Forman (BF.B)

Altria (MO)

PepsiCo (PEP)

Kraft (KFT)

Campbell Soup (CPB)

Hormel Foods (HRL)

McCormick (MKC)

Procter & Gamble (PG)

Colgate-Palmolive (CL) - Borderline for inclusion on this list

Kimberly-Clark (KMB)

Clorox (CLX)

Chubb (CB)

IBM (IBM)

NextEra Energy (NEE) - Formerly FPL Group

Wisconsin Energy (WEC)

Southern Company (SO)

Inclusion on this list does not mean that they all currently represent fundamentally attractive investment opportunities. Nor does it mean that they haven't been subject to some lumps at other times outside of the QE Pause of last summer. And certainly other stocks outside of the quality universe used here also held up well during this time period (a point I will revisit in a future post). But what this list does provide is a reasonable group of companies to watch for potential inclusion in a portfolio in anticipation of the potential end (or perhaps pause) to QE2 coming in the near-term forecast.

This post is for information purposes only. There are risks involved with investing including loss of principal. Gerring Wealth Management (GWM) makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections made by GWM. There is no guarantee that the goals of the strategies discussed by GWM will be met.

Whether the Fed will actually follow through with ending QE2 at the end of June will remain a subject for debate in the next few months. But holding the Fed to their recent word, the time is now to look ahead and try to determine which investments might hold up best once QE2 is over.

When the Fed ended QE1 in Spring 2010, the stock market immediately dropped -17% in a matter of weeks. Seeking to avoid this type of downside volatility post QE2 in the second half of 2011, I went searching for those stocks that performed well through the last "QE Pause" during Summer 2010.

My search criteria was the following. First, I focused my search on quality stocks - if QE2 is going to end with a global economy still on shaky footing, I'd like to hold the companies that are set up to weather any pending storm best. I used the S&P 500 High Quality Rankings Index to provide me with my candidate stock list. Next, I focused my analysis on the period from April 26, 2010 when stocks peaked at the end of QE1 to August 27, 2010 when Fed Chairman Ben Bernanke confirmed that QE2 was on its way in his Jackson Hole speech and the stock rally started anew. Finally, I screened the universe for stocks that experienced only short and limited declines during this stretch (-11% or less) and maintained upward price momentum throughout this time period. Out of the 125 in the universe, I was left with a list of 19 stocks, which I've listed below.

Ecolab (ECL)

McDonald's (MCD)

Hasbro (HAS)

Brown & Forman (BF.B)

Altria (MO)

PepsiCo (PEP)

Kraft (KFT)

Campbell Soup (CPB)

Hormel Foods (HRL)

McCormick (MKC)

Procter & Gamble (PG)

Colgate-Palmolive (CL) - Borderline for inclusion on this list

Kimberly-Clark (KMB)

Clorox (CLX)

Chubb (CB)

IBM (IBM)

NextEra Energy (NEE) - Formerly FPL Group

Wisconsin Energy (WEC)

Southern Company (SO)

Inclusion on this list does not mean that they all currently represent fundamentally attractive investment opportunities. Nor does it mean that they haven't been subject to some lumps at other times outside of the QE Pause of last summer. And certainly other stocks outside of the quality universe used here also held up well during this time period (a point I will revisit in a future post). But what this list does provide is a reasonable group of companies to watch for potential inclusion in a portfolio in anticipation of the potential end (or perhaps pause) to QE2 coming in the near-term forecast.

This post is for information purposes only. There are risks involved with investing including loss of principal. Gerring Wealth Management (GWM) makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections made by GWM. There is no guarantee that the goals of the strategies discussed by GWM will be met.

Tuesday, March 8, 2011

And So It Begins . . .

"The higher you climb, the harder you may fall"

Fundamentals have not mattered. Technicals have not mattered. Instead, since the days following the outbreak of the financial crisis, the stock market has moved in lockstep with the massive $1.7 trillion expansion of the Fed's balance sheet (see chart). When the Fed is actively engaged in asset purchases (QE1, QE2), the stock market rallies. And when the Fed is not buying assets (Spring/Summer 2010), the stock market plunges. Nothing else seems to matter but the Fed. European sovereign debt crisis, Middle Eastern social unrest, soaring commodities prices and a sluggish economy are all ignored due to the intoxication of freely flowing money from the Fed each day. A market that has risen on little more than air for two years is troubling to say the least.

Over the last several days, the Fed has expressed with increasing swagger that it will bring QE2 to an abrupt end when it expires in June. Whether they are still so bold come June remains to be seen, but taking the Fed at their word today, what can we expect from investment markets once it all comes to an end?

To begin with, those that suggest that stocks can continue to rally without more QE are misguided. Sure the economy has recovered from the depths of the crisis, but stocks already reflect any recovery we've seen so far and a lot more. We would need to see economic activity pick up dramatically in the next few months to even begin to start supporting stocks at current valuations. This is very unlikely.

As a result, the outlook for stocks is poor once QE ends in June. What type of correction can we expect? Fortunately, the end of QE1 provides some insight. QE1 ended in April 2010, and the stock market quickly plunged by -17% in just 10 weeks into July 2010. And stocks would have likely fallen further had the market not begun to speculate that QE2 was coming around the corner. Today, the market is +10% higher than it was at its peak in April 2010 at the end of QE1, so we should expect the magnitude of the correction at the end of QE2 to be easily -20% or more.

What about timing? The stock market decline last time around was coincident with the end of QE1. This time around, many are anticipating the stock pullback at the end of QE2, so we should expect a move to the exits that slowly begins to creep in at least a few weeks in advance.

So where will the money flow? Last time around, the money flowed out of stocks and into safe haven assets including U.S. Treasuries, Investment Grade Corporate Bonds, Gold, the U.S. Dollar and Volatility. Whether we see the same money flow trends at the end of QE2 is subject to debate, but is the key to the puzzle in generating returns in the second half of 2010 (or until the Fed opts to step in with QE3). This is a topic I will be dissecting and exploring in more detail in future posts over the coming weeks.

In the meantime, the float higher in stocks appears likely to continue, risks be damned.

Fundamentals have not mattered. Technicals have not mattered. Instead, since the days following the outbreak of the financial crisis, the stock market has moved in lockstep with the massive $1.7 trillion expansion of the Fed's balance sheet (see chart). When the Fed is actively engaged in asset purchases (QE1, QE2), the stock market rallies. And when the Fed is not buying assets (Spring/Summer 2010), the stock market plunges. Nothing else seems to matter but the Fed. European sovereign debt crisis, Middle Eastern social unrest, soaring commodities prices and a sluggish economy are all ignored due to the intoxication of freely flowing money from the Fed each day. A market that has risen on little more than air for two years is troubling to say the least.

Over the last several days, the Fed has expressed with increasing swagger that it will bring QE2 to an abrupt end when it expires in June. Whether they are still so bold come June remains to be seen, but taking the Fed at their word today, what can we expect from investment markets once it all comes to an end?

To begin with, those that suggest that stocks can continue to rally without more QE are misguided. Sure the economy has recovered from the depths of the crisis, but stocks already reflect any recovery we've seen so far and a lot more. We would need to see economic activity pick up dramatically in the next few months to even begin to start supporting stocks at current valuations. This is very unlikely.

As a result, the outlook for stocks is poor once QE ends in June. What type of correction can we expect? Fortunately, the end of QE1 provides some insight. QE1 ended in April 2010, and the stock market quickly plunged by -17% in just 10 weeks into July 2010. And stocks would have likely fallen further had the market not begun to speculate that QE2 was coming around the corner. Today, the market is +10% higher than it was at its peak in April 2010 at the end of QE1, so we should expect the magnitude of the correction at the end of QE2 to be easily -20% or more.

What about timing? The stock market decline last time around was coincident with the end of QE1. This time around, many are anticipating the stock pullback at the end of QE2, so we should expect a move to the exits that slowly begins to creep in at least a few weeks in advance.

So where will the money flow? Last time around, the money flowed out of stocks and into safe haven assets including U.S. Treasuries, Investment Grade Corporate Bonds, Gold, the U.S. Dollar and Volatility. Whether we see the same money flow trends at the end of QE2 is subject to debate, but is the key to the puzzle in generating returns in the second half of 2010 (or until the Fed opts to step in with QE3). This is a topic I will be dissecting and exploring in more detail in future posts over the coming weeks.

In the meantime, the float higher in stocks appears likely to continue, risks be damned.

This post is for information purposes only. There are risks involved with investing including loss of principal. Gerring Wealth Management (GWM) makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections made by GWM. There is no guarantee that the goals of the strategies discussed by GWM will be met.

Subscribe to:

Posts (Atom)