* Portugal braces for government collapse over austerity vote

* Ireland’s 10-year bond yield hits record at over 10%

* Bombing in Israel bus station

* Yemen’s pro-U.S. leader in talks on exit

* U.S. new home sales lowest on record, prices fall to December 2003 levels

* Federal Reserve rejects Bank of America dividend raise

Investment markets do not like uncertainty. And on any normal trading day, simply one of these headlines alone might provide justification for stock investors to take pause and reevaluate risk exposures. So with six such major headlines in a single day, it would have been more than reasonable to expect that stocks might head lower for the trading session, as investors would be inclined to take some money of the table as they analyze the implications of some if not all of these events. And such risk aversion would be particularly prudent in a stock market that has nearly doubled since the March 2009 lows and has risen by over +30% in a virtual straight line since last summer.

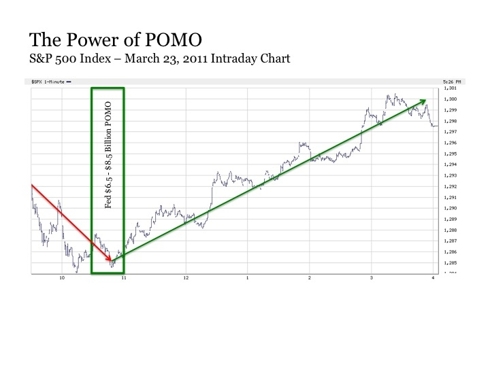

When trade opened yesterday morning at 9:30AM, a pullback was exactly what we saw, as the market quickly dropped by roughly -1%. But once we entered the second hour of trading, the downward trend suddenly reversed. By 10:30AM, the market showed signs of bottoming. And through the remainder of the morning and the rest of the trading day, the market elevated steadily higher to end the day up +0.5%. The fact that the market ended up on a day when a variety of new and meaningful risks bubbled to the surface certainly raises an eyebrow. After all, whether it's to the upside or the downside, you want to make sure your in a market that is acting at least somewhat rationally.

Trading days just like yesterday have become all too familiar over the last few years – down at open on negative news, bottom mid morning, rally through the remainder of the day to end higher. This raises the obvious question – what is happening around 10:30AM that sparks this market resilience to shake off any and all signs of worry and start ascending higher? The answer – the U.S. Federal Reserve.

Nearly every trading day, the Fed conducts Permanent Open Market Operations (POMO) starting at 10:30AM as part of their latest $600 billion asset purchase plan widely known as “QE2”. Between 10:30AM and 11:00AM, the Fed buys anywhere between $5.5 billion to $8.5 billion in U.S. Treasury securities from financial institutions such as the major banks. So by late morning on any given trading day, we have financial institutions that suddenly have a load of cash that they just received from the Fed and now need to do something with it. And a good chunk of this money has been finding its way into investment markets including stocks, which helps ignite the reversal and propel stocks higher. In other words, the Fed has essentially become the marginal buyer of stocks through their Open Market Operations.

This process has two key implications going forward. First, the Fed’s QE2 is set to run through June 30, 2011. As long as QE2 is running – we are currently around $360 billion, or 60%, through QE2 through today with 98 calendar days left before June 30, 2011 – it is reason expect these mid-morning reversal up days will continue to occur with regularity regardless of what risks the world throws at it. Second, the daily marginal buyer for stocks is set to go away once QE2 ends. Thus, a day like yesterday that opens down but reverses and heads higher is likely to become a day that opens lower and accelerates to the downside as the day progresses. It is also worth noting that the infamous stock market flash crash occurred on May 6, 2010, just days after the Fed rounded out QE1 back in late April of last year. As a result, increase volatility should be expected post QE2 and such unpredictable flash crash episodes should not be ruled out either. In short, current imperviousness to risk may quickly become heightened sensitivity to risk once QE2 goes away.

The bottom line – there’s likely still time to ride the stock wave higher between now and June. But barring a dramatic economic acceleration or rumblings of QE3 in the coming months, investors will be wise to beware what might lie ahead for stocks in the aftermath of QE2.

(This post is for information purposes only. There are risks involved with investing including loss of principal. Gerring Wealth Management (GWM) makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections made by GWM. There is no guarantee that the goals of the strategies discussed by GWM will be met.)